Purchase your dream home with POSB

A Bridging Loan helps you to meet your temporary cash flow needs. It allows you to commit to buying a new property even before receiving the proceeds from the sale of your existing property. You can borrow up to 20% of the property purchase price, with a repayment period of up to 6 months, to meet the initial down payment on your new property.

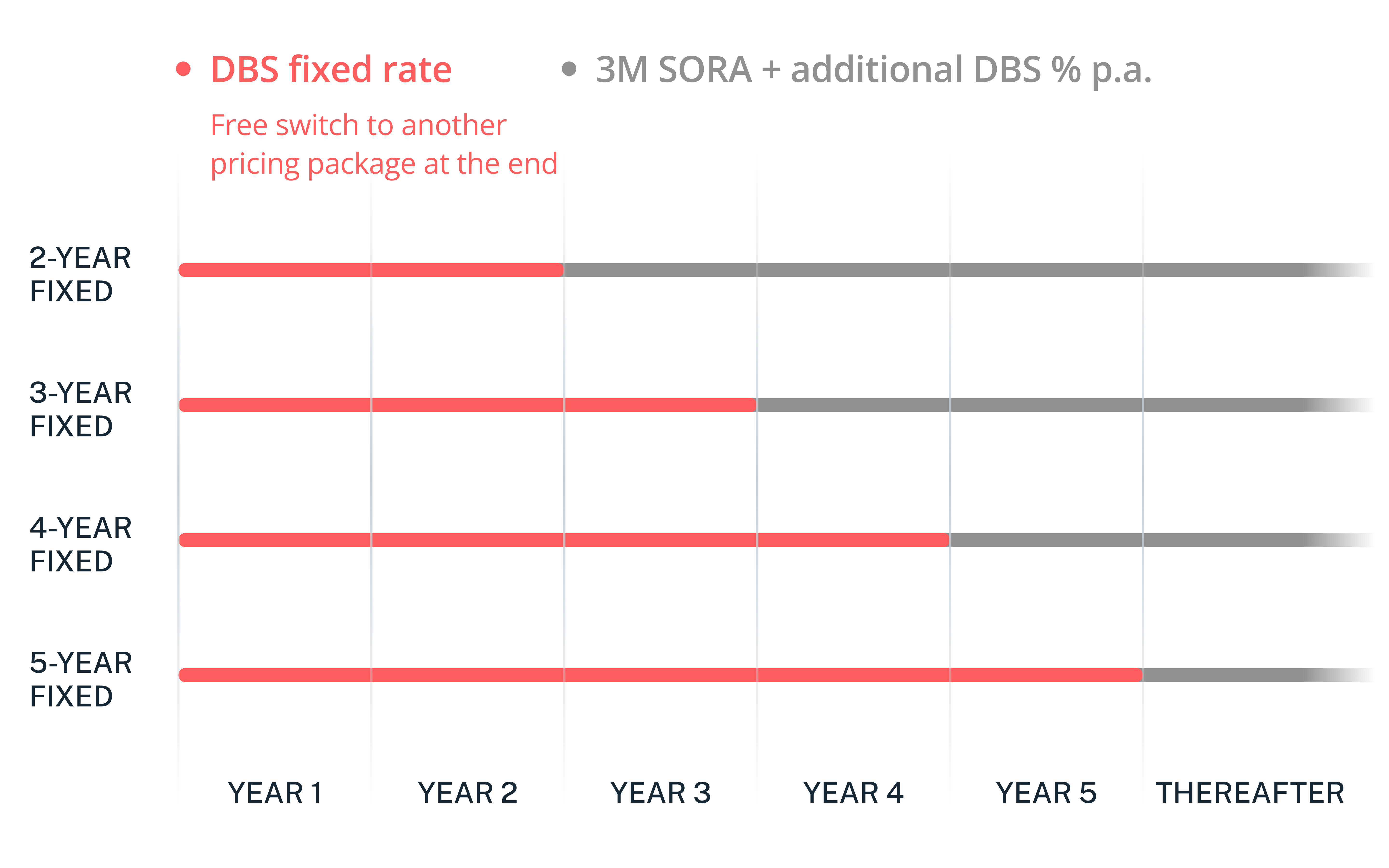

Our fixed rate packages maintain the same interest rate over a fixed tenure. Enjoy a lock-in fixed rate for your loan package regardless of market conditions. Once the fixed period lapses, your fixed rate will become a floating rate.

Features | |

|---|---|

| Minimum loan amount of S$100,000. |

| Choose between 2-5 year fixed POSB interest rate. Contact us for our current rates, and we’ll get back to you within the next working day. |

| Switch to another pricing package at the end of your fixed rate period for free. |

For full list of associated costs, read our DBS Home Loan Fees and Charges.

Features | |

|---|---|

| Minimum loan amount of S$100,000. |

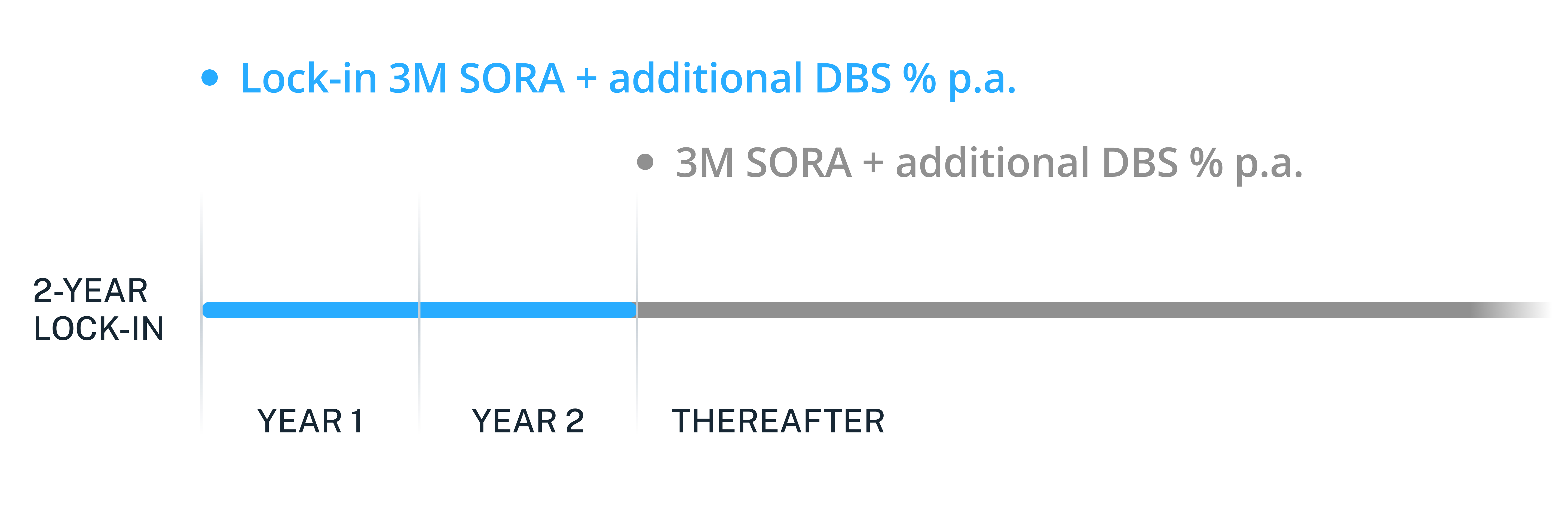

| The lock-in 3M SORA or FHR rate will be calculated from the day you take up the bank loan. Contact us to find out more about 3M SORA or FHR, and we’ll get back to you within the next working day. |

| Switch to another pricing package at the end of your fixed rate period for free. Only applicable for 3M SORA packages. |

For full list of associated costs, read our DBS Home Loan Fees and Charges.

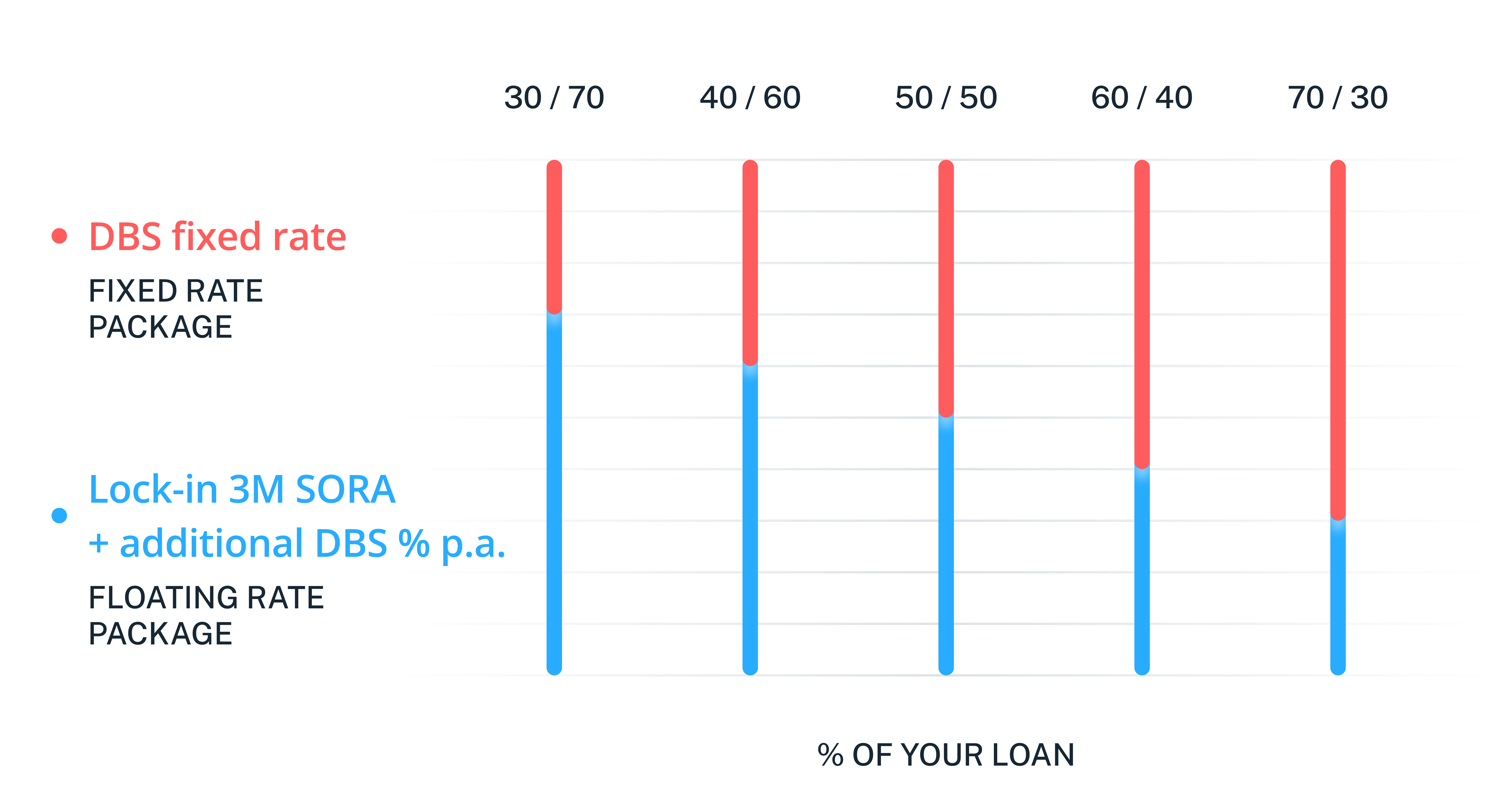

Can’t decide between our fixed rate and floating rate packages?

Customise your loan package and enjoy the benefits of both packages in one loan, based on your needs.

For full list of associated costs, read our DBS Home Loan Fees and Charges.

| Definitions of pricing terms | |

|---|---|

3M SORA | The Singapore Overnight Rate Average (SORA) is an interest rate benchmark, and it reflects the actual transactions between banks, made between 8am and 6.15pm in Singapore. 3M SORA refers to 3M compounded SORA rate which is based on a compounding period of 3 months of the historical SORA rate. SORA fluctuates on a daily basis, so if you re-taking a housing loan with your interest rate pegged to SORA, your loan repayments will change too. |

FHR | FHR6 refers to Fixed Deposit Home Rate 6, a reference rate unique to DBS. FHR6 is calculated based on the prevailing 6 months Singapore dollar fixed deposit interest rate of DBS Bank for amounts within S$1,000 to S$9,999. |

It is valid for 30 days from approval date. A home loan IPA is an approved loan amount based on the affordability of the borrower. However, it is not a binding document, and the final loan is subject to the property purchase price, valuation and other checks.

For your first property loan, the minimum downpayment is 25% of the purchase price, of which 5% must be paid in cash. The balance can be paid using your CPF savings.

The monthly instalment amount will be debited from your POSB loan servicing account on each due date. If you plan to use CPF to service your monthly instalment, inform your lawyer to set up the arrangement.

We’re just a message away. Contact us for personalized assistance on your home loan journey.