By Navin Sregantan

![]()

If you’ve only got a minute:

- With the start of a rate cut cycle, it might be a good time to review investments and consider new opportunities.

- On the income end of the Barbell Strategy, consider investing in high quality bonds, banks, and S-Reits for dividend plays. On the growth end, consider long-term secular trends like I.D.E.A. plays.

- When considering these ideas, always take note of your investment objectives, investment capital, time horizon and risk tolerance levels, among other things.

![]()

Optimism was high at the start of 2024 for rate cuts. However, these hopes were quickly dashed as persistent inflation and the resilience of the US economy prompted the US Federal Reserve to stand pat on interest rates.

But with moderation in US headline inflation as well as concerns surrounding the job market in August 2024, Fed Chair Jerome Powell revealed that it was time to adjust monetary policy.

While it did take longer than most expected, the US central bank finally cut rates, serving up a bumper 50-basis-point cut to the US Fed Funds rate to the 4.75% to 5% range.

This is not only the first rate cut since March 2020 but it marks the much awaited Fed pivot. Markets are now pricing in 3 to 4 rate cuts by end-2024.

Read more: 4 money habits to achieve financial wellness

Investment ideas amid rate cuts

When the Fed embarked on its rate hike cycle, interest rates were upped 11 times from March 2022 to July 2023. As a result, fixed income was thrust into the spotlight as investors sought attractive yields from high-quality fixed income options, which were available a few years before.

In Singapore, fixed deposits, T-Bills, and Singapore Savings Bonds, dominated market discussion among retail investors.

With the start of a rate cut cycle in mind, it might be a good time to review investments and consider new opportunities and ask: “How can investors take note of, or take advantage of the current environment?”

Before doing so, remember that as investors, we all need to understand our investment objectives, investment capital, time horizon and risk tolerance levels to assess which of these ideas are suitable.

Moreover, bear in mind that these investment ideas work in line with the Barbell Strategy, an investment approach advocated by DBS Chief Investment Office (CIO) since August 2019.

Simply put, a portfolio that follows this approach has an Overweight exposure in Growth equities like those that ride on long-term, irreversible growth trends.

The other end of the portfolio has an Overweight exposure to Income assets like high-quality government and corporate bonds, along with dividend-yielding equities and real estate investment trusts (Reits).

For investors looking to diversify or add positions to their portfolios as the Fed pivots, consider these 5 investment ideas that we are about to share.

Find out more about: ‘T-bill & Chill’? Invest smarter

1. Short duration, high quality bonds

With the rate hikes of the past 2 years behind us, markets are expecting lower rates in 2024 and 2025.

DBS CIO is of the view that investors can consider locking in higher yields in short-duration, high quality fixed income instruments like investment grade (IG) corporate bonds.

This means investing in bonds with a credit rating of at least BBB with a duration of 1 to 3 years to capitalise on the turn of the rate hiking cycle to minimise cash reinvestment risk.

Given that short-end rates (i.e. fixed income with maturities of ≤ 1 year) are the most impacted once cuts ensue, bonds with a duration of 1 to 3 years stand to gain with more certainty from a repricing of the rate environment.

digiPortfolio’s SaveUp portfolio, provides a low-risk and high-quality exposure to the fixed income market. As of end-August 2024, the Save-Up portfolio was generating a yield of 5.0% p.a. with an IG credit quality and a portfolio duration of 2 years. The portfolio’s yield is significantly higher than its long-term projected range of 1.5 to 2.5% p.a..

Even though there is a transition from a pause to a cutting cycle, bond investors should continue to switch from cash into fixed income as the higher yields available today may not be as easily found tomorrow.

Find out more about: digiPortfolio on digibank

2. Yield plays in Reits

Given their higher gearing ratio and sensitivity to financing costs, Asia-focused Reits are prime beneficiaries of interest rate cuts.

As the core business model of Reits revolves around leveraging debt to finance their property deals, lower interest rates should reduce financing costs and enhance profitability. This, in turn, leads to higher distributions to investors, making Reits more attractive as income-generating investments.

In particular, there is value emerging for Singapore Reits (S-Reits) as an important income generator with its 5% to 6% annual yield over rate cycles. With the US dollar weakening, global investors may to seek higher returns outside of the US.

S-Reits are appealing in the environment of declining rates and play a pivotal role on the income side of the Barbell Strategy. They are also attractive from a valuation front and have sound financial metrics.

Among S-Reits, we prefer retail, industrial, office, and hotels given their ability to deliver earnings surprises on the back of resilient organic and inorganic income generation abilities.

Find out more about: Invest-Saver

3. Income-generating equities

One of the most accessible ways to earn passive income is through investing in dividend stocks, especially those of mature companies – known as Blue-Chips – with stable revenue, profits and cashflow.

Using the S&P 500 as a proxy, analysis by DBS CIO suggests that based on previous rate cutting cycles, utilities, consumer staples, and healthcare tend to outperform on a 3-month basis after the initial cut.

In particular, utilities also provide an above-average dividend yield of 3% (vs S&P 500’s 1.4%), and this is attractive for income-seeking investors.

In Asia, slowing US growth and declining global rates tend to favour Asia’s domestic oriented markets and central banks have more policy room for monetary easing. This should bode well for Asian Blue-Chips as well as China’s large banks, among others.

Investors who prefer exposure to equity markets with the option of receiving regular income can consider digiPortfolio’s Income Portfolio (minimum investment of S$1,000).

The Income Portfolio gives you access to income-generating equities (including Asia Reits) as well as fixed income securities, in a readymade solution. It also distributes regular income.

As of end-September 2024, the portfolio generated an income of around 4.9% p.a. (1.2% per quarter), contributed by a mixed-asset portfolio of income equities, high quality government and corporate bonds.

Find out more about: digiPortfolio on digibank

4. Sticking with a good I.D.E.A.

Technology is already an omnipresent part of our lives as the global economy shifts to becoming a digital one.

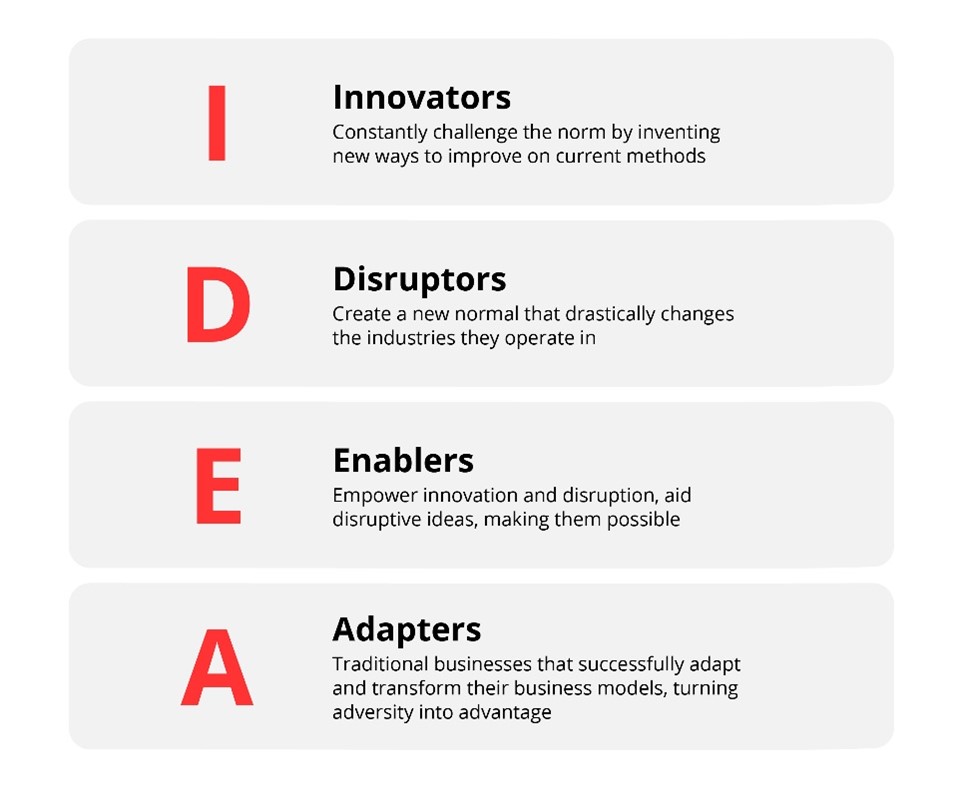

DBS CIO coined the acronym I.D.E.A. (Innovators, Disruptors, Enablers, Adapters) to encapsulate the types of companies that will be winners of this new digital world.

The acronym represents:

This group of companies include but are not restricted to US Big Tech firms and the leading players in the artificial intelligence (AI) space.

The recent Tech sell-down on the S&P 500 presents opportunities for investors to jump onto the AI bandwagon. DBS CIO is of the view that the AI revolution is still in its infancy, holding immense growth potential.

Moreover, companies in the technology sector tend to hold on to greater amounts of profits as retained earnings to reinvest in growth opportunities. More importantly, growth isn’t funded by debt and capital management has been disciplined.

In the tech-related space, investors can consider seeking opportunities in “adapter” companies that are adopting the usage of AI to enhance their business operations.

To add, digitalisation is a long-term secular trend, which will persist regardless of business cycles and central bank policies. Investors can consider staying invested and thinking long-term.

5. Gold remains part of the arsenal

2024 has been a banner year for gold. The shiny yellow metal, which gained 15% in 2023, is up by over 20% in the first 3 quarters of this year.

Amid Fed rate cuts, the US dollar is likely to see weakness. This bodes well for gold prices, which are generally inversely related to the value of the greenback.

Geopolitics is another key short-term driver for gold. The latest development here is on the rising tensions in the Middle East due to Iran-Israel tensions.

In Europe, the Russia-Ukraine conflict also shows no signs of abating, and one can in fact expect complications should former US President Donald Trump be re-elected in November. Given his vocal critique of the US aid package to Ukraine, Trump may curtail further military and financial assistance if elected for a second time.

A longer-term driver for gold is purchasing by central banks amid concerns of de-dollarisation and monetary debasement.

Net gold purchase by central banks remained robust at 119.2 tonnes in June 2024 and surveys conducted by the World Gold Council suggest that gold will make up a larger proportion of total global reserves in the future.

DBS CIO continues to advocate for investors to have holdings in Gold as a portfolio risk diversifier and black swan hedge. This is so as Gold is a source of additional non-market directional returns.

The end-2024 price forecast for gold has been revised up from US$2,500 per ounce to US$2,835 per ounce.

In Summary

Most assets tend to perform well when the Fed cuts interest rates. However, do not be overly focused on chasing the next best opportunity amidst changing conditions.

Investors should remain invested in the markets and diversify their portfolios to ensure they are well-balanced and positioned to thrive, regardless of market fluctuations.

While these are some investment ideas for you to ponder over, do remember that it is vital for all investors to understand themselves and their needs.

This means taking note of your investment objectives, investment capital, time horizon and risk tolerance levels, among other things.

Doing so will not only help you better understand which ideas are more suited to you but shape your investment decisions.